Why Nasdaq Stock Fell 10.7% in December

What happened

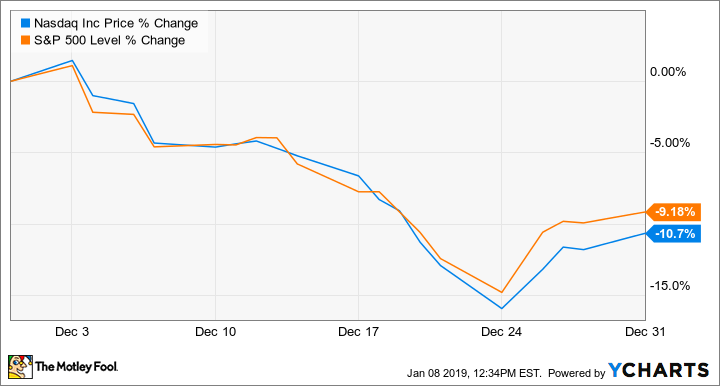

Shares of Nasdaq (NASDAQ: NDAQ) declined more than 10% last month, according to data provided by S&P Global Market Intelligence, coinciding with a broader move lower by the overall market.

Image source: Getty Images.

So what

Nasdaq's decline closely mirrored that of the S&P 500 (SNPINDEX: ^GSPC) in December.

It's therefore likely that the sell-off in Nasdaq's shares was related to a general "risk-off" rotation; investors reduced their holdings of stocks as concerns regarding rising interest rates, trade tensions between the U.S. and China, and a government shutdown all helped to usher in a bear market.

Now what

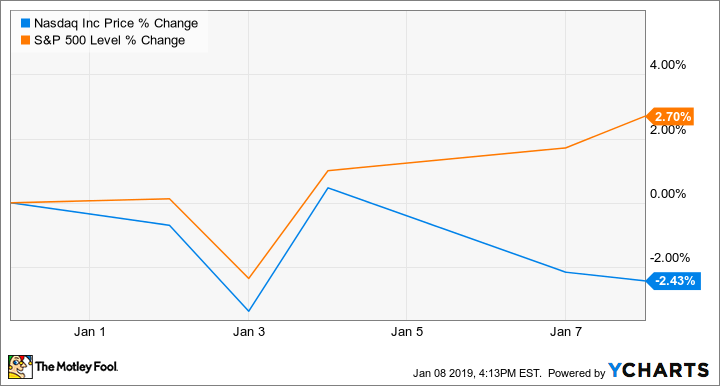

However, Nasdaq's stock price movements so far in January have diverged from that of the market as a whole. While the S&P 500 has risen nearly 3%, Nasdaq's shares are down by nearly that same amount.

On Jan. 7, Reuters reported that several powerful financial institutions, including Bank of America, Morgan Stanley, Charles Schwab, TD Ameritrade, and Fidelity, plan to launch a low-cost exchange to compete with Nasdaq and the New York Stock Exchange. This new stock-trading platform, which will be called Members Exchange, or MEMX, expects to file an application to operate as a national securities exchange with the Securities and Exchange Commission later this year.

Investors appear to be concerned that MEMX could put pressure on Nasdaq's ability to increase prices on its data feeds, which, in turn, could weigh on the company's margins. It's too early to tell if this new exchange will be successful in gaining market share, but Nasdaq investors should watch this situation closely in the coming months.

More From The Motley Fool

Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool recommends Nasdaq. The Motley Fool has a disclosure policy.