The US drilling boom is in full effect as cost reductions have improved profitability

Heavyweights in the energy industry have gathered in Houston for CERAWeek, presented by IHS Markit, to discuss the most pressing issues facing the sector.

The central theme permeating the speaker’s podium: how US drillers are continuing strength and domination with respect to production, while resiliency during the price downturn drove cost efficiencies that have made production more profitable as oil now trades around $50.

“Costs are about 50% of what they were a few years ago,” said Michael Wirth, CEO of Chevron, in a discussion with Daniel Yergin, Vice Chairman of IHS Markit.

“Technology is driving efficiency and performance,” Wirth elaborated. “Shale resources in the Permian are much larger than originally estimated.”

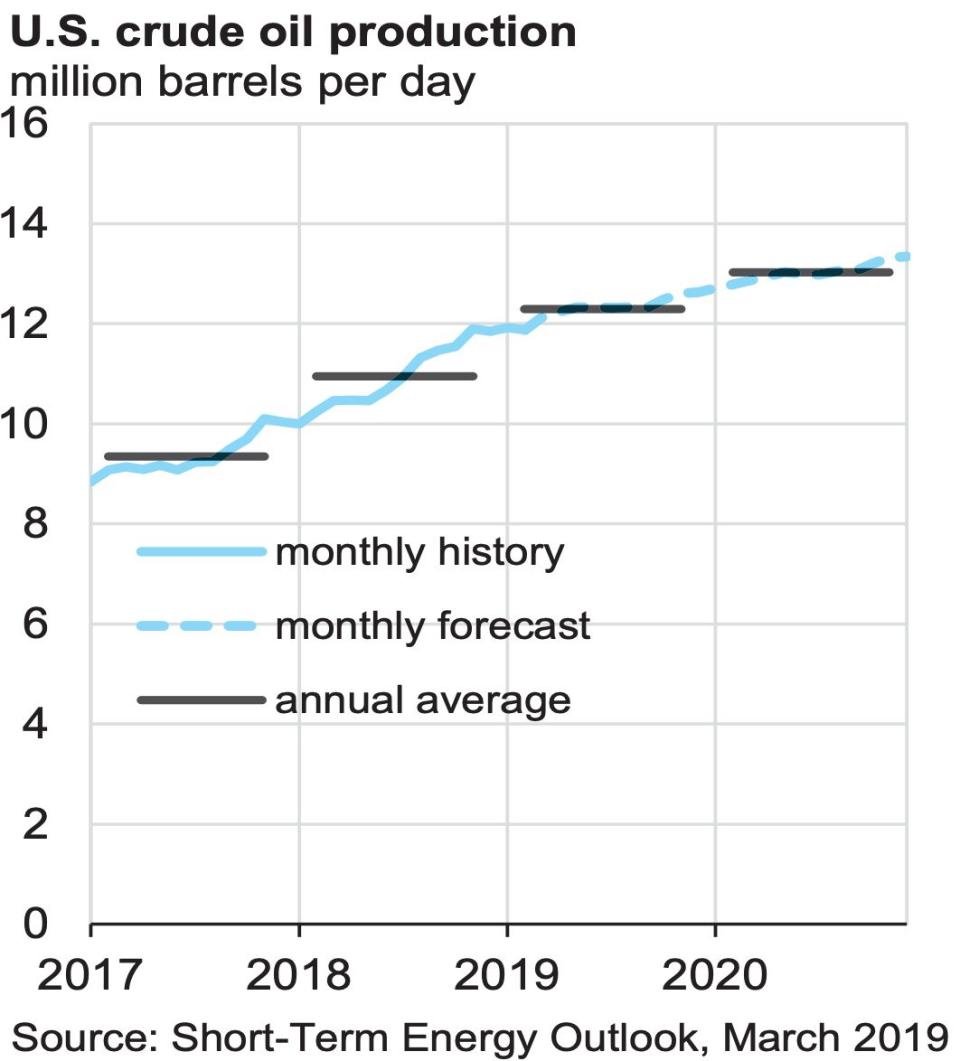

And it’s not just the Permian Basin. Production is booming in the Bakken, and continues to see strength in the Gulf Coast. The latest data from the US Energy Information Administration shows the US is producing around 12 million barrels of oil a day, a figure that has skyrocketed over the last five years.

The US surge in output comes comes at at a time, when OPEC in cooperation with Russia, has cut nearly 2 million barrels a day to stabilize volatile prices. According to OPEC’s latest Monthly Report, production has decreased to 30.8 million barrels a day, with Saudi Arabia contributing only 10.2 million barrels per day. Russia’s production is estimated around 11 million barrels a day, making the U.S. the world’s largest producer. And in due time, the U.S. could become the largest global exporter as well.

The big question now: have prices stabilized around the $50 mark? Energy leaders in Houston seem to think prices will see some movement but will gravitate around that level.

One key caveat however, is the crisis in Venezuela. According to OPEC’s monthly report Venezuela pumps 1.1 million barrels a day, well off its highs, but still significant. If the country’s political crisis worsens, as evidenced by the recent blackout, it could threaten that contribution. While it may subtly impact price, the impact may not be what it would have been a decade ago.

“In August of last year the United States surpassed Russia as the world’s top producer,” said Mike Pompeo, US Secretary of State in his CERA Week remarks. “When it comes to global supply, U.S. production is growing at the fastest pace in history... We imported 60% of our oil, we have shrugged off that dependence.”

—

Jackie DeAngelis is an anchor for Yahoo Finance. Follow her on Twitter: @JackieDeAngelis

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.