Crude Oil Price Forecast: Channel Floor Sees Bullish Outside Day

DailyFX.com -

To receive Tyler’s analysis directly via email, please SIGN UP HERE

Talking Points:

Crude Oil Technical Strategy: Waiting to Sell On Strength

Entering Idea Zone For a Bounce, Working on Bullish Key Day

Sustainability of Upside on Bounce Is In Doubt

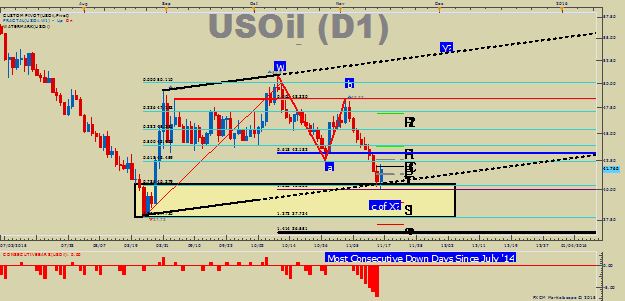

Late Monday, WTI Crude Oil bounced off key support to stage an attempt on a Bullish Key Day. A Bullish Key Day happens when a daily candle shows a low below the prior day’s low, yet closes above the prior day’s high. In other words, price action completely engulfs the prior day and closing above the prior day’s high signals that sellers were nowhere to be found into the close. The rout in Oil had extended to 8 straight days going back to November 4th, the longest such strength since July 2014. Any subsequent rally in Oil will have levels of resistance to break through before a serious rally is considered, and of the firmest levels to focus on will be the November 4th high of $48.33bb. Another reason to doubt a serious rally at present is due to the big picture for continued strength in the US Dollar. The US Dollar has marched higher since October 15th and until support breaks for the US Dollar the August 24th lows could come into view very soon for Oil.

Over the years, I’ve gained a fondness for looking to reversals within the price range of an extreme day. Today, the low in Crude Oil was 40.04. On August 24th, the day we printed a YTD low in oil (and many other assets), the price ranged from $37.73-$40.45bbl. Within the August 24th, price range aligns two key levels as per Fibonacci ratio analysis very close to each other that stood out on the crude oil price chart. Both levels, the 78.6% Fibonacci Retracement Support and the Fibonacci Expansion from October & November extremes on WTI / Crude Oil of the August-October range sits at 40.00-40.54. Should a Bullish Key Day materialize near these levels, we’ll look at the short-term resistance of $42.57, the October 27th low followed by $43.81, the Weekly R1 Pivot.

Even a bullish key day in and of itself does not guarantee a bullish cycle is underway on Crude; it would need to be confirmed with other correlated markets joining along to increase credibility. We recently noted that extended on the downside isn’t the equivalent to a buy signal unless you’re day trading. In aggressive bear markets, which the last year of price action would qualify for, rallies are better treated as selling opportunities with a better risk-reward ratio than was previously available. However, a break above noted resistance would favor a retest of the November high of $48.33 over the August low of $37.73. T.Y.

We hope you enjoyed this short-term Oil Outlook, be sure to sign up for our free oil guide here.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.